Question: What is the source of the City’s affordable housing funds?

Answer:

The City uses the following funding sources for the City’s affordable housing loans: Low-income Housing Development Impact fees, former Redevelopment Agency Housing Funds, and grants (federal HOME funds from the U.S. Department of Housing and Urban Development, State of California Permanent Local Housing Allocation funds (PLHA), CalHOME, and BEGIN funds).

Question: What types of projects and services are the affordable housing funds spent on?

Answer:

The projects and services funded through the City’s affordable housing trust provide affordable housing in the City by assisting in the private and nonprofit development and preservation of affordable owner and rental housing and other related programs that help residents enter or remain in affordable housing.

Project types include:

- The development of new and rehabilitation of existing affordable rental housing

- Down payment assistance for low and moderate-income first-time homebuyers to purchase homes in Livermore

- Housing support and assistance for people experiencing homelessness

The affordable housing funds are mainly used by the city to issue loans for development, acquisition, rehabilitation, home purchase and downpayment assistance. Current loans in the City’s portfolio include:

Low-income Housing Development: $24.3 million of loans outstanding

The largest outstanding loans include: $5.7 million for Vineyard 2.0 housing on North Livermore, $2.3 million for Eden Housing in downtown, and $10 million for MidPen to construct Avance Housing on 1st Street.

- Development: Funds expended by the City in a form of flexible payment low-interest loans to nonprofits developing rental housing projects on private or public property. Because affordable rental housing requires a deep subsidy to operate, many loans to nonprofit developers are structured to require repayment only after there is sufficient funding in the project to cover all annual expenses and fund reserves. The City’s loan is considered a permanent investment in the project.

- Example: In 2018, the City provided a $4.587 Million loan to MidPen Housing for permanent housing development financing for the 44-unit Chestnut Square Family Apartments.

- Acquisition: Loans for City-owned properties which reflect the appraised value of the land, but do not involve an exchange of funds for land.

- Example: Eden Housing received both a $500,000 predevelopment loan from Affordable Housing funds and an acquisition loan for the value of the City-owned property which is the site of their downtown apartments.

Inclusionary/Home Ownership: $19.1 million of loans outstanding

Outstanding loans include: Inclusionary, "silent second" loans to first time homebuyers averaging $250,000 per loan.

- Inclusionary: Homebuyer loans recorded as deferred “silent” second mortgages for the buyers of new Below Market priced homes. The value of these loans represents the home developer’s contribution towards the City’s affordable housing requirements and the interest is deferred for the term of loan. These loans may be repaid by the homeowner at resale or may be transferred through the City’s program to another income eligible buyer.

- Example: A developer of a new residential townhouse fulfills the City’s Inclusionary Housing ordinance and sells a 3-bedroom unit at a Below Market Price of $547,000 to a Moderate-Income homebuyer. The market price of the unit is $950,000. The City takes a “silent” second mortgage for the difference of $403,000 which becomes a loan to the homebuyer held by the City.

- Homeownership: Down payment assistance and rehabilitation loans to income eligible buyer/owners. Repayment terms are based on the original source of funds (i.e. State or City) and the income level of the borrowers.

- Example: A low-income, first time homebuyer applies to the City for a Down Payment Assistance loan of $60,000 to buy a market priced condo in Livermore. The City provides the loan to assist with the purchase and because the City used State CalHome funds, no annual payments are due until the owner decides to move out of or sell the home.

Rehabilitation: $1.4 million of loans outstanding

Outstanding loans include: Loans to low-income homeowners for emergency repairs averaging $35,000, and rehabilitation loans to nonprofit housing organizations to rehabilitate affordable rental housing.

- Rehabilitation: loans for rental properties that serve extremely low-income, vulnerable populations operated by nonprofit organizations, and loans for properties owned by individual low-income homeowners. The City has used State grants for these projects.

- Example: Tri-Valley REACH shared home rehabilitations. The City has supported the nonprofit housing provider, Tri-Valley REACH, to renovate and expand shared homes for people with developmental disabilities. The City provided low interest (3%, annual) loans which only require payment after all operating costs and reserves are met so that projects can operate and provide proper support services. In 2023, the City provided REACH with a loan of $116,800 to expand a townhouse from 3 to 4 bedrooms and provide independent housing for an additional Livermore resident with a developmental disability.

Question: How is the City tracking the use of the affordable housing funds?

Answer:

To track City homebuyer loans, staff uses a client management system that includes all borrower information. Loans with amortization and required payments are serviced by contract through Amerinat. City staff uses in-house software to track multi-family housing development loans.

Question: How much money is available to fund low-income housing efforts?

Answer:

As of June 30, 2024, $15 million is available to fund low-income housing efforts.

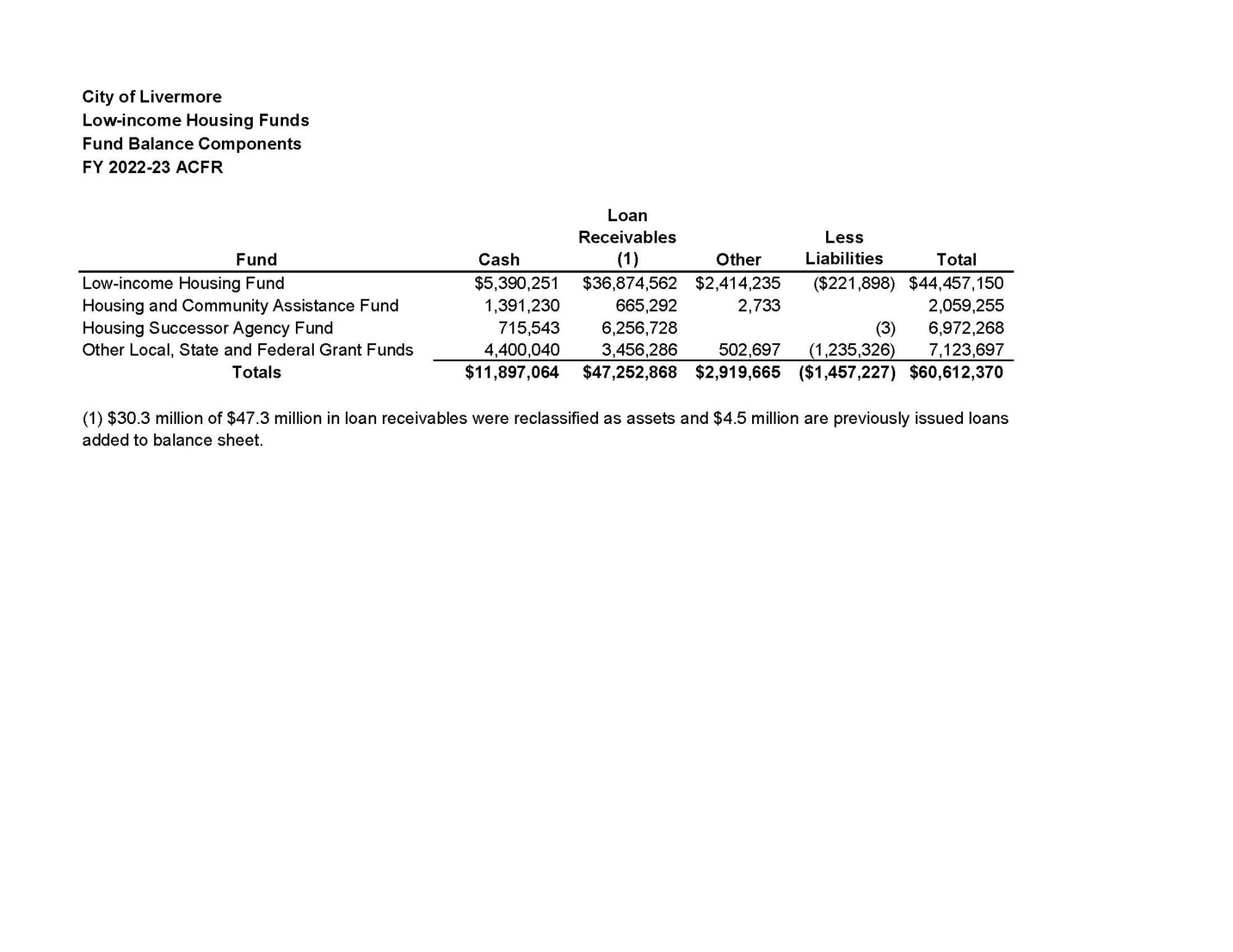

Fund balance table of affordable housing loan funds: